Nada Ihab

Artificial Intelligence

Dana Ramadan

Public Sector

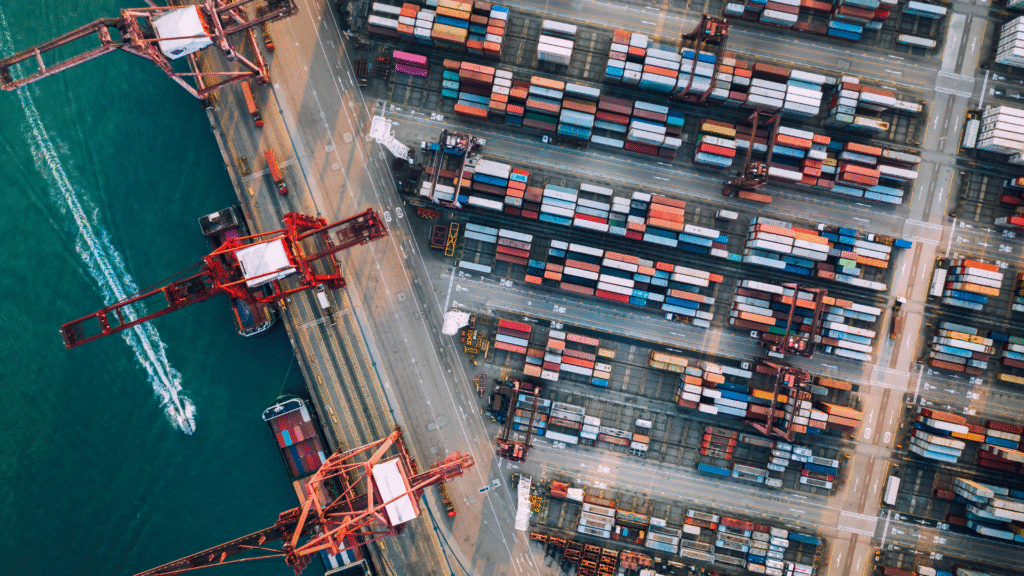

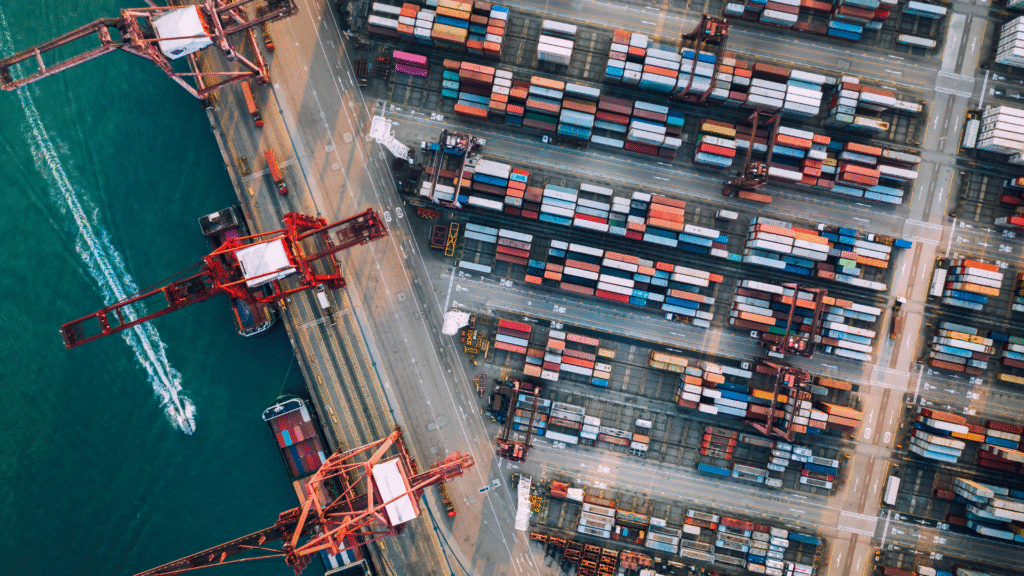

China has recently implemented two changes to its trade policies that have potentially significant implications for private sector companies trading with it; specifically, technology companies ranging from chipmakers and automakers to defence companies. These changes involve: 1. Amendments to the Counter-Espionage Law, expanding the definition of espionage activities and empowering China’s National Security Authority to pursue action against suspected violators; and 2. New export control laws on gallium and germanium, requiring companies wishing to ship these key resources abroad to secure state permission. Access Partnership has detailed these policy developments here.

These recent trade developments affect foreign partnerships and the export of key materials. As such, many in the West have reacted to these policy developments, with some calling them a retaliatory move against countries that have imposed strict trade rules on China to curb its technological advancement – notably, the US and Dutch restricted exports to China in 2022 and 2023, respectively. Specifically, the restrictions apply to semiconductor technology exports, including chipmaking tools. Notable reactions include those from the US, Germany, the Netherlands, and the European Union (EU).

For its part, Germany is securing long-term supplies of critical raw materials and has concerns about expanding export controls to other materials. The Dutch government, which recently introduced rules requiring a licence to export chipmaking equipment to China, called for an EU response. The latter emphasised compliance of the new trade measures with World Trade Organization rules and is assessing their impact on global supply chains.

On 6 July 2023, US Treasury Secretary Janet Yellen visited China and expressed concerns over export controls, addressing what she described as “unfair economic practices”. Both China and the US have expressed a willingness to restore balance in their relationship, notwithstanding internal deliberations within the Biden administration to limit Chinese companies’ access to US cloud-computing services.

Beyond immediate challenges in due diligence, compliance, and supply chain management, there are several other potential implications:

Access Partnership is closely monitoring developments regarding global trade policies. For more information regarding the impact of China’s new trade developments on its tech partners in the Middle East and other emerging markets, or should you require support to mitigate the risks posed to your company, please contact Nada Ihab at [email protected] or Dana Ramadan at [email protected].