Álvaro Ovejero

Space & Connectivity

News about space investment is now mushrooming in both specialised and non-specialised media about the space industry. Recently, the US released the President’s Budget for Fiscal Year 2024, adding up to USD 27.2 billion for the National Aeronautics and Space Administration (NASA) [1]. In addition, Spain announced the creation of its own Spanish Space Agency to be headquartered in Seville [2], the UK Space Agency announced several funding programs to boost their domestic space industry [3], and South Korea have set a record-high budget to develop a domestic next-generation launch vehicle with a promise to double the budget over the next five years. These are just a few examples, but the trend is clear: there is a revitalised interest in the space industry and the space economy. There are more than 90 space agencies or civil space programs in the world, many of which have only started operations in the last decade [4].

The space economy is valued at around USD 469 billion [5], and it is estimated that it will reach USD 1 trillion by 2040 [6]. From its current value, over one fifth of this total is driven by government spending – and it is projected to increase further [7]. This means that space agencies make a key contribution in helping develop the local and international space industry.

The role of space agencies and governments becomes particularly relevant during times of economic turmoil. The space industry is currently facing financial headwinds. After achieving a record level of investment in 2021, to the value of USD 47.5 billion across the market; 2022 marked a significant decline in investment of 52% to just 20.1 USD billion amid global financial market decline [8].

This scenario can be concerning given that the space sector, despite massive advancements in technology and associated cost reductions, remains capital intensive. Space provides scale, which makes it attractive to venture capitalists. The lack of depth of financial markets in different jurisdictions, along with the need for longer term multigenerational investments, are certainly challenges that will cause some start-ups to inevitably fail, and the sector will tend to go through a process of consolidation. Many companies were founded in the last decade and will need more time to mature and start generating revenue.

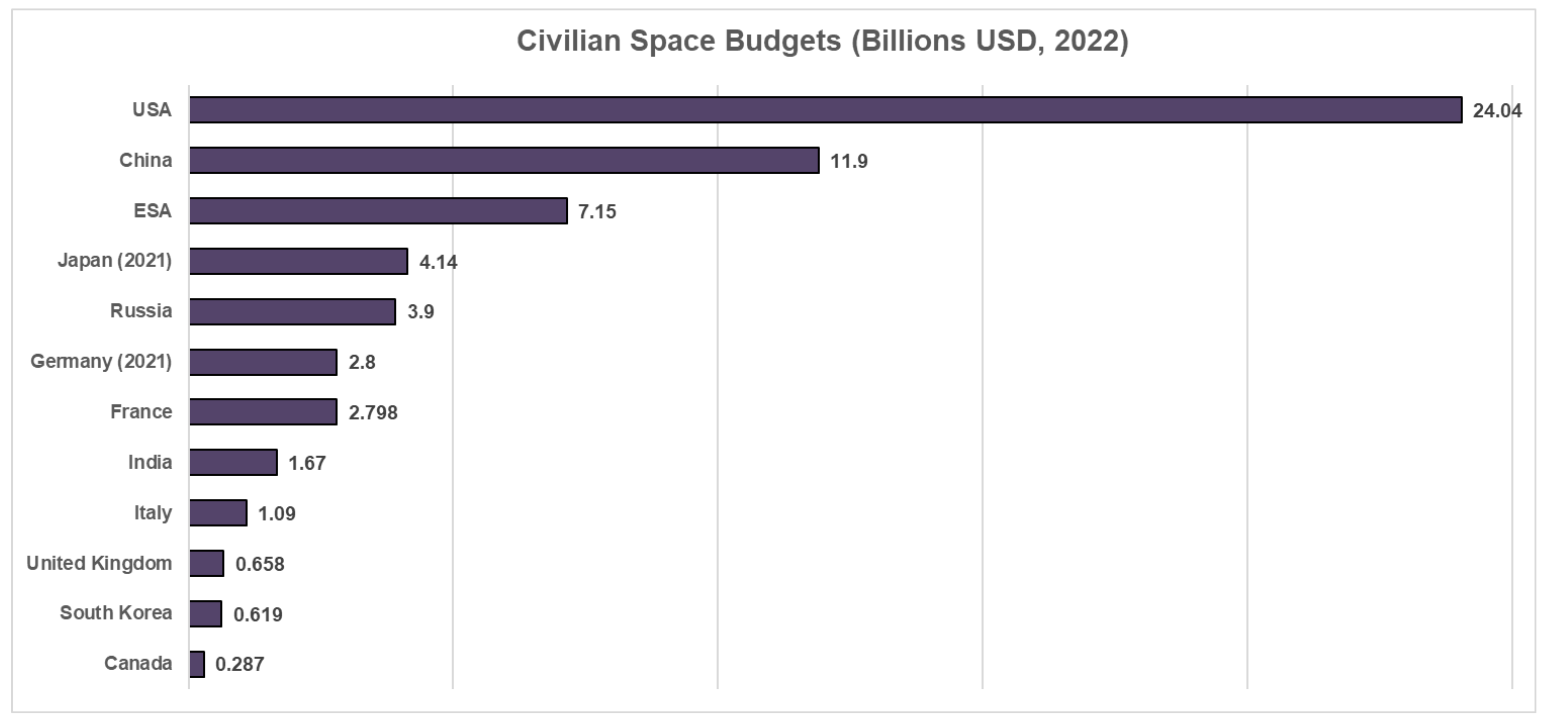

This is where space agencies are stepping in. They are increasing investor appetite for space by introducing capital flows that can help unlock risk capital into the sector. Governments are the first customer of many start-ups and are stable clients of myriad companies linked to national security and other space capability-related strategic ventures. This characteristic would be expected to continue as geopolitical tensions rise. Investors will find assurance on companies that managed to strike government contracts; and those companies will then have a two-fold benefit: the government spending and the private investment it, in turn, unlocked. The graph below showcases how countries (and regions) have devoted sizeable resources to developing their space capabilities:

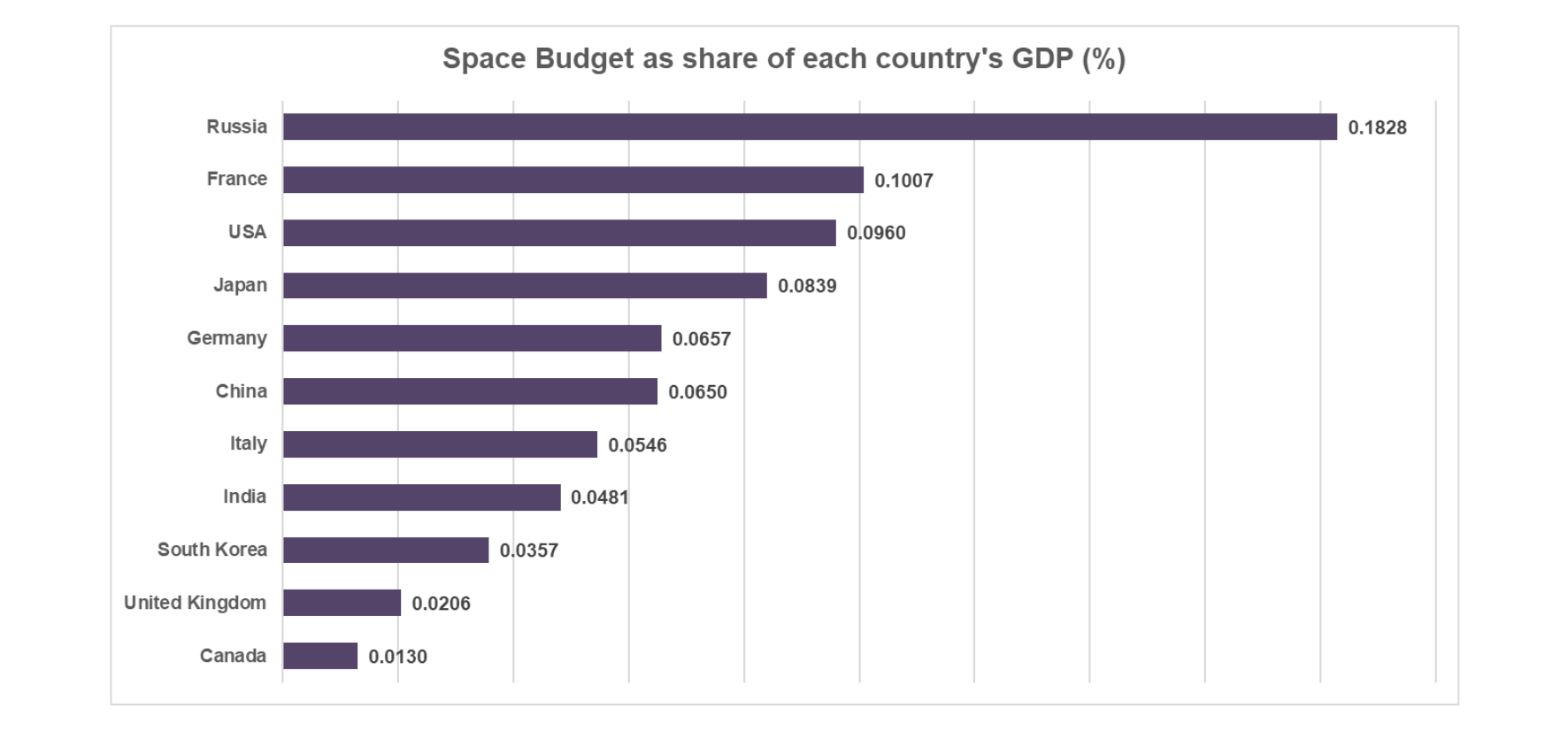

The United States retains the top slot due to NASA’s budget, furthermore, this does not account for the entire national space budget in the US. China ranking in second is also not a surprise, as the country continues to ramp up its space spending to achieve the goals set up by its 2022 Space Program whitepaper. Both Japan and France have seen drastically increased proposed budgets for national space activities in 2022 (and 2023), making them stand out on the international stage. The European Space Agency (ESA) budget appears smaller in year-to-year tracking, but the agency receives funding in three-year increments. The ESA budget for 2023-2025 has increased sharply by 22% for a total of 20.3 billion USD. In addition, the following bar chart showcases space agency budget as a share of each country’s GDP, thus reflecting the relevance that countries assign to it.

As outlined by the graph, Russia, France, and the USA civil space programs rank at the top of the chart, aligned with their national priorities. Numbers may have to be taken with a pinch of salt, as civil and military categories tend to overlap in some countries; however, they help establish a broad stroke picture or snapshot of the space government spending situation.

In sum, government and space agency spending can counter-cyclically sustain the commercial sector while it matures, safeguard it from economic downturns, boost private investment, and grant overall resilience to the industry. Space agencies are engaging in capacity-building, organising networking and match-making events, and overall explaining the value that the sector holds to different stakeholders. This does not only impact the private sector, but local economies also benefit from the growth of domestic space industries that hire highly-skilled workers and spill-over regionally. The economic impact that these institutions have on the local economies can be measured, as recent reports issued by NASA and the OECD showcase.

The relevance of space agencies as drivers and anchors of the space economy is undeniable. In the wake of decreased private equity investment in new space activities, national agencies play a unique role in spurring innovation and reaping the benefits of space exploration and research. National Space Agencies are not accountable to shareholders and do not need to offer significant returns on investment, making them the ideal funders for experiments, scientific innovation, and exploration activities in outer space. National Space Agencies can be key strategic partners for the private sector through funding, infrastructure sharing, and collaboration. New-space operators should keep an eye on governments as allies, partners, and customers to help the industry navigate space, and these tumultuous economic times.

Access Partnership closely monitors tech and space, regulation, and policy developments. For more information, please contact: Álvaro Ovejero [email protected], Ivan Suarez [email protected], and Daniel Batty [email protected].