Fernando Borjón

Senior Advisors

Rodrigo Serrallonga Mejía

Data Governance

On 13 April, U.S. Treasury Secretary Janet Yellen mentioned in a speech that the United States should favor friend-shoring supply chains to many trusted countries to secure market access and lower risks to the U.S. economy.

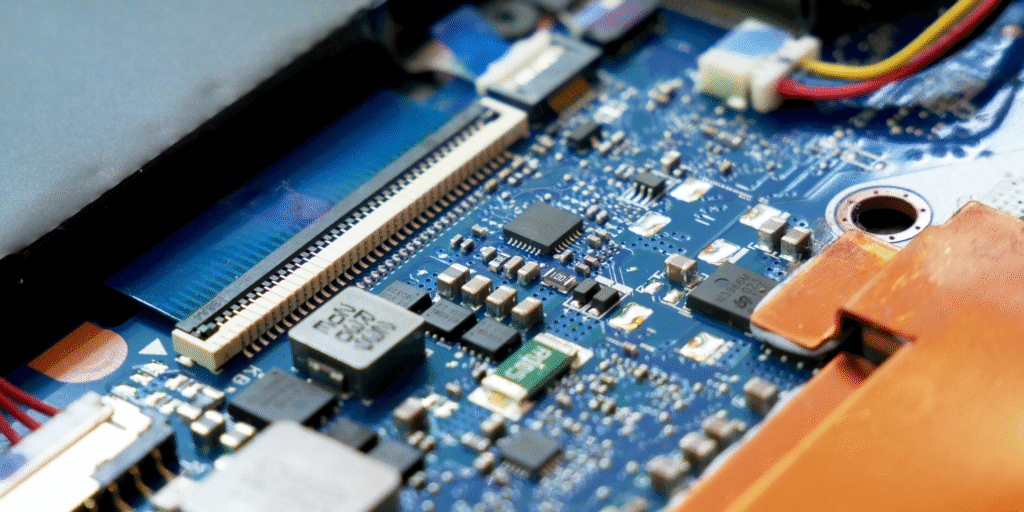

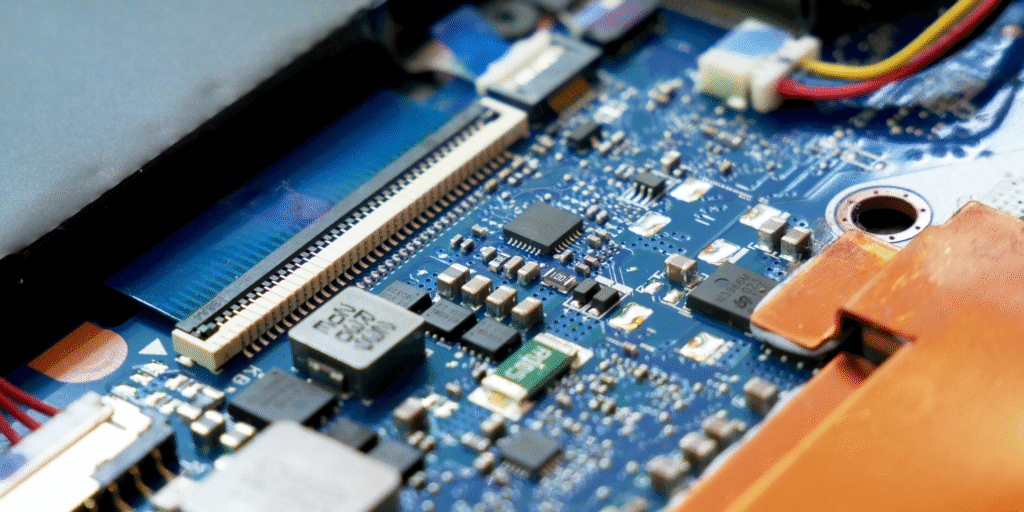

An overreliance on China for critical materials and products during the COVID-19 pandemic exposed the vulnerabilities of U.S. supply chains. With 70% of the world’s semiconductor chips being manufactured in East Asia, a global chip shortage would result in severe economic losses to the U.S. economy and threaten U.S. national security. As detailed in ‘Semiconductors: A Global Policy Review,’ these materials are critical to the modern and digital economy not only because they are a key building block in all electronic devices, but also because they enable new products, services, and industries.

One solution to mitigating supply chain risks and geopolitical tensions is ally-shoring or friend-shoring –the process by which countries shift critical supply chains and source essential materials, goods, and services between trusted democratic partners and allies.

Ally-shoring represents a unique opportunity for the U.S. to rethink its strategic alliances and pivot its supply chains of semiconductors and other advanced technologies to Mexico.

In September 2021, the United States and Mexico relaunched the High-Level Economic Dialogue (HLED) to advance strategic economic and commercial priorities, including strengthening the resilience and competitiveness of U.S.-Mexico semiconductor supply chains. By moving production to Mexico, U.S. electronics and semiconductor manufacturers would benefit from Mexico’s proximity labor cost advantage, a skilled workforce, and its proximity to the U.S.

Mexico is the sixth-largest technology producer in the world. With annual exports of USD 70 billion in technology products to the U.S.—only behind China—the Information Technology (IT) industry is Mexico’s primary export and represents one-third of electronics manufacturing in the country. Semiconductors, already identified as critical to U.S. economic security, are suitable for ally-shoring approaches, where distances between production sites and global markets are paramount to ensuring supply chain integrity and intellectual property protection. The U.S. must leverage Mexico’s fertile manufacturing environment and its prime geographical position to ensure supply chain integrity, reduced logistics time, and intellectual property protection.

Similarly, Mexico offers a sophisticated infrastructure of technological talent and globally engaged firms committed to forward-leaning innovation. While chip production is highly capital-and skills-intensive—meaning that transferring this production would be neither cheap, easy, or quick—semiconductor production in Mexico is not new.

Jalisco, an innovation-driven high-skilled state in western Mexico, serves as the poster child of this opportunity. At the forefront of the strategy is Governor Enrique Alfaro. His drive to boost the state’s tech profile led him to visit Silicon Valley, where he recently announced over USD 610 million in investment to create more than 8,000 jobs in the electronics industry. Moreover, Intel revealed USD 8 million in investments for a design center in Guadalajara, and Flex unveiled USD 100 million to expand operations in the auto industry and build a new manufacturing center. Big tech firms like Google are also partnering with Jalisco to equip 10,000 teachers with computers and digital materials.

Tapping into Mexico’s skilled growing workforce could help address shortages in the U.S. talent pipeline. Similarly, investing in developing digital skills and education would allow Mexico to build a more robust and competitive twenty-first-century workforce.

For ally-shoring to successfully serve as a strategy to expand U.S-Mexico tech cooperation, the United States will need to prove its commitment to promoting ally-shoring. Current legislation in Congress, such as the CHIPS Act, which supports semiconductor production reshoring to the United States, raises important questions about U.S. commitment to ally-shoring. The U.S. Congress must pass the H.R.7579 Western Hemisphere Nearshoring Act, a bipartisan bill which seeks to expand commercial ties between the U.S. and the Western Hemisphere, while reducing dependency on Chinese manufacturing, curbing migration, and creating jobs for U.S. workers.

However, Mexico also has to do its part. The country, especially at a federal level, should strengthen its business climate to attract foreign investment, while working with U.S. companies on projects that can expand the production of semiconductors in Mexico. If it fails to achieve this, other countries such as Brazil will likely step up to the challenge and poach investments. This already happened in 2018 when Millicom decided to open in Brazil a new semiconductor plant.

If you are interested in learning more about ally-shoring in the Americas, or how to leverage this opportunity for your business, please contact Fernando Borjon, Yamel Sarquis or Rodrigo Serrallonga.