Driving, still fundamentally similar to when the automobile was first popularised through the 1920s, has long been targeted for digital innovation. Connectivity technologies for cars have been gathering momentum since the 1990s, improving safety and efficiency. However, many services are still at an early stage of adoption. Reaching their full potential may come with vehicles becoming fully automated — but it will also need the auto industry, national and local governments, and tech companies to address the regulatory and technical challenges.

From Theory to Practice

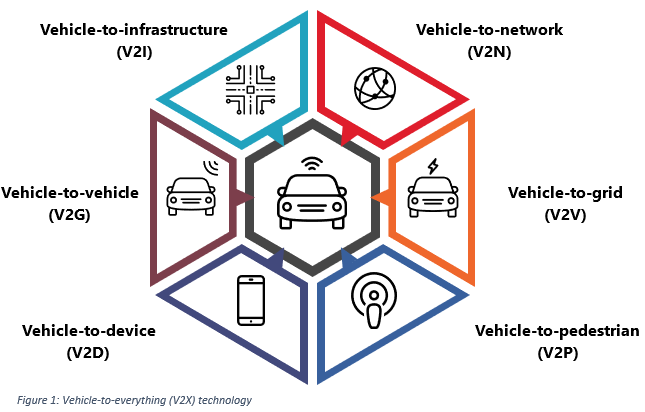

Connected cars, broadly speaking, aim to reduce accidents, improve driver information and make travelling by car more enjoyable by connecting vehicles with other vehicles, traffic systems, and moving objects. They achieve this through vehicle-to-everything (V2X), a vehicular communication umbrella system that incorporates several different types of communication.

Of the sub-types, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) hold the most potential for changing how driving is experienced. V2V communications is the sharing of basic information about speed, direction, position, and braking status with neighbouring cars. Vehicles form an ad-hoc wireless mesh network with each car, transmitting, receiving and retransmitting messages within around 300 meters. This has the potential to greatly improve safety; every year, hundreds of thousands of people are killed in motor vehicle accidents around the world, with overall deaths rising with increased vehicle usage in developing regions and per capita deaths remaining flat despite safety improvements in many parts of the world.

However, in order to reach the full potential of V2V, a critical mass of cars need to be equipped with the proper technology. General Motors estimates that V2V will be effective once 25% of the cars on the road are equipped, which might not be achieved until 2022 in the United States.

Vehicle-to-infrastructure (V2I), meanwhile, allows the vehicle to communicate with stationary infrastructure components like traffic lights, which also would become nodes in the mesh network, improving traffic safety (through warnings for hazardous situations, intersection improvements, or rail crossing operation), congestion (such as traffic jam notification, dynamic traffic light control, and parking assistance), emissions, and air pollution.

These two technologies will also require the greatest change in how connectivity is delivered — ubiquitous, seamless broadband is essential for these impromptu mesh networks to function.

To achieve this, several industry groups are advocating replacing the older radio technology (based on the 802.11p standard) used for V2X communications with a cellular standard (C-V2X), which combines cellular network communications with direct communications between vehicles, infrastructure and other road users. It leverages the comprehensive coverage of well-established 4G/LTE (and future 5G) networks, supporting a much wider range of capabilities than any other vehicle connectivity solutions. Whereas 802.11p’s short-range communications require around 5 to 10 steps on the network to gather traffic conditions a mile ahead and relies on as many vehicles/nodes, C-V2X can enable single-step real-time communication. This long-range communications capability of C-V2X will also help to better anticipate traffic conditions.

While still a nascent technology, V2X is already making driving safer. Once its deployment reaches a critical mass, it will also enable advanced autonomous driving in the future. However, while the technology is already commercialised and will make incremental gains over the next few years, the financial investment in and longevity of cars means it will take a long time before drivers see a radical change.

The Connected Car Challenges

Before reaping the benefits of connected cars, public and private interests must first address the challenges that come with a new technology, such as defining a regulatory framework and industry standards, resolving safety and security hurdles, provisioning smart road infrastructure and cellular network infrastructure, and advocating for public acceptance. Once the regulatory landscape is defined, car manufacturers, satellite providers, and mobile operators will also need to address the following challenges:

Built-in vs. brought-in applications

There are two methods to connect cars to the web. Built-in options provide stronger and better-integrated connections, and Auto OEMs (original equipment manufacturer) are creating their own devices, giving them greater control over the services offered and how closely these are integrated into vehicle capabilities. However, some consumers prefer connecting their existing smartphone (brought-in applications) to the car via Bluetooth or USB to access their own personalised applications (such as messaging apps and music).

Lifecycle management

The difference in lifecycles in the automotive and the mobile industry is a serious challenge for the future of connected cars. New features and applications, such as operating system upgrades, are provided almost constantly for the smartphone whereas car manufacturers work on five-year cycles. Several car manufacturers have only recently moved to over-the-air (OTA) update systems that can install patches as they’re published, while others still require owners to bring their cars to dealers to update software, vastly increasing security risks.

Regulations

As providers of telecom services, industry actors might become subject to country-specific telecom regulations, such as lawful intercept and in-country entity requirements. The interoperability of the various platforms as well as the cross-border use cases will have to be discussed and regulated. The reliance on data networks also raises the question of net neutrality, where some data is given transmission priority by Internet service providers.

Spectrum

Mobile and data-hungry connected cars will need ubiquitous frequencies. Spectrum is allocated by the International Telecommunication Union, which will look into Intelligent Transport Systems and 5G spectrum during the upcoming World Radio Conference (WRC-19).

Cybersecurity and data privacy

Given the fragmented nature of the connected car ecosystem and some lack of awareness, connected cars are vulnerable to cybersecurity breaches. Recent car models with deeper connected systems have been vulnerable to hackers seizing control of parts of the vehicle, allowing remote hackers to brake, steer or accelerate a vehicle with dangerous consequences. Connected vehicle security needs to be part of vehicle design — an integral part of the vehicle lifecycle that is regularly updated. Alongside cyber attacks, there is a real threat of data breaches, such as fraud and identity theft, and potential data privacy infringement.

In addition to technical and regulatory challenges, industry must also respond to consumer concerns. According to a McKinsey report, consumers worry most about digital safety, data privacy, hacking, and cost. While the need and demand for connectivity is increasing, consumer fears about security present a challenge for the auto industry. As such, public engagement and multistakeholder collaboration between car manufacturers, the cybersecurity industry, and regional regulatory authorities is required to address these various obstacles and promote the widespread adoption of connected cars.

Authors:

Alexis Martin, Director, Technical Advisory, Access Partnership

Ivan Ivanov, Marketing Manager, Access Partnership