The US may be ready to bet the house in its trade dispute with China. So, what happens now?

On Tuesday 10 July, the Trump administration threw another curveball in the spiralling US-China trade war with a fresh tariff list targeting $200 billion in Chinese goods with a 10% tariff. The shock action was foreseen by few in Washington or Beijing and comes hot on the tail of actions to finalise and apply the first tranche of $50 billion in tariffs.

You can be forgiven if the back and forth of escalating threats and retaliation has left your head spinning — because this is the intent. As it carries out the conclusions of the Section 301 investigation into Chinese forced technology transfer practices, the Trump administration is pursuing a strategy designed to keep the Chinese government off balance. The latter have fittingly complained about the US’ “capricious” behaviour: the muddled messages and repeated raising of stakes is a classic Trumpian negotiating strategy, designed to raise pressure on bilateral trade talks as much as possible. We can expect more of the same.

What could be next?

Trump himself has indicated that he may be prepared to bet the house in the dispute. Since April, he has specifically directed the office of the US Trade Representative (USTR) to consider hundreds of billions of dollars in tariffs – potentially covering the entirety of US imports from China. Taken at face value, they add up to a total of $550 billion ($150 billion with a 25% tariff; $200-400 billion with a 10% tariff).

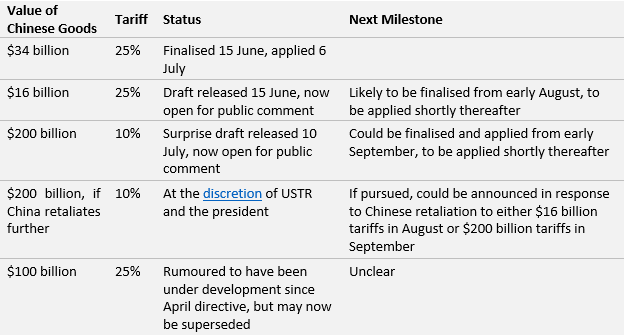

Table 1: Status of US Implemented Tariffs

These Presidential actions have created several specific cards that his administration can — and probably will — play over the coming weeks and months to escalate tensions and keep the US in the driver’s seat.

The USTR now has the tools to take a series of actions to propose, finalise, and apply several tranches of tariffs over the next few months, keeping a steady drum beat of escalating pressure. What’s more, they also have legal leeway to delay imposing tariffs for up to 180 days, maximising their ability to shape negotiations.

The US is also pulling out a series of creative tools to generate additional leverage. The Section 301 tariffs have already been preceded by steel, aluminium, and solar panel tariffs implemented under other trade remedy laws — not to mention the potentially fatal US export ban placed on Chinese telecommunications company ZTE, used to extract heavy concessions. While President Trump punted a few weeks ago on ratcheting up restrictions on Chinese investment, Congress is set to enact a tough new national security review process to screen foreign investments — probably with heightened scrutiny for China.

US pursing a chaotic offense

It’s impossible to predict how or when the US administration will play the cards it holds, but there is no sign that the US will release pressure any time soon. In fact, there is every indication that they will continue a deliberate strategy of escalation to seek the strongest possible negotiating position.

Prior to mid-June, the US and China were engaged in a series of high-level trade talks. The US opened with several major asks, including: reducing the US-China trade deficit by $200 billion; improving foreign investment; and the wholesale dismantling of the Made in China 2025 industrial strategy.

This jumble of goals reflects the similar jumble of egos and priorities among US officials. While hardline advisors Peter Navarro and US Trade Representative Robert Lighthizer are likely to push for deeper, structural concessions from the Chinese, some of Trump’s other advisors — including US Treasury Secretary Mnuchin, Commerce Secretary Ross, and National Economic Council Chair Kudlow — may attempt to broker a deal to remove tariffs without Chinese concessions on Made in China 2025. This latter set of officials are likely to seek a quicker off-ramp to the dispute. Even if they find success with the Chinese, it is doubtful these efforts would satisfy their boss, who seems to prefer being egged on by his more hardline advisors.

China on the defence

Chinese leadership have been put on the back foot by the aggressive US escalation. The head of the Chinese negotiating team, Vice Premier Liu He, was shocked by news in June that the US would apply tariffs. Less than a month earlier he had declared victory, claiming that both sides had agreed to end the trade war. Now, they have cancelled all tentative deals with the US.

For now, China is more focused on blunting the impact of tariffs than on escalation and claiming the moral high ground. Apart from the ZTE case, China is likely to take a defensive approach in the trade war in the upcoming months and only respond if Trump makes the first step.

Domestically, they have started implementing $127 billion tax reduction for strategic industries identified by the Made in China 2025 plan. The government has also promised to spend the money collected from tariffs on US goods on domestic victims of the trade dispute.

Internationally, Beijing is courting the Europeans to cultivate new export markets and to build a coalition against President Trump. In late June, China and the EU held their 7th annual High-level Economic and Trade Dialogue, where China confirmed its commitment to join the WTO Government Procurement Agreement (GPA) and proposed to expand the One Belt One Road initiative to EU. Leaders will have a second opportunity to discuss trade on 16-17 July at the Sino-European summit in Beijing.

Brussels, however, shares Washington’s core concerns over China’s forced intellectual property transfer practice, and is more likely to sit on the sidelines of the US-China trade dispute or even cooperate with the US and Japan in building pressure at the WTO. Beijing is therefore focusing on central and eastern European countries with its One Belt One Road infrastructure investment proposals, hoping to leverage their influence within consensus-driven European decision making.

China had brought negotiations with the US to a screeching halt after the US pledged to apply tariffs. Now that some tariffs are in place and more appear imminent, it is unlikely China will be able to sustain this bluff and may have to come back to the table.

Who’s at risk?

Just about every sector of the US economy has supply chains that run through China in one way or another and will feel the pain if the trade dispute continues to escalate.

Consumer goods were scrupulously avoided in the first two rounds of US tariffs, which focused instead on capital and intermediate goods. That will be increasingly difficult as the dispute escalates, meaning that individual Americans will face new and bigger price tags for many common goods. The recently released third list gives a taste of this, capturing more consumer products like routers, vacuums, furniture, and air conditioners.

The sector with the most to lose is technology. While tech companies and consumers largely (though not entirely) escaped unscathed in the first tranche of $34 billion, the proposed $16 billion and $200 billion lists put a shot across the bow of the semiconductor industry and ding routers and computer components. If the US remains focused on Made in China 2025 – which at its core is about Chinese dominance in emerging technology – these and more tech products will be collateral damage sooner rather than later.

It will get worse before it gets better

Legal and political clocks are now ticking, and we can expect a flurry of actions in the next few months.

Given the commitment of Chinese leadership to implement Made in China 2025 and the laser-like focus of Trump’s hardline trade advisors on dismantling it, worst case scenarios cannot be ruled out. We may be on track for all bilateral trade between the US and China being subject to tariffs.

Americans vote in midterm elections in early November. While they won’t like the painful hikes in consumer prices or market declines that will result from tariffs, Trump clearly believes that the idea of tariffs are a political winner and will use them to pander to his base.

Look for the administration to continue rapid escalation, possibly committing to billions more in tariffs in the next few months, but to delay application until after the election. Unless the Chinese leadership manifests a new willingness to make meaningful policy changes the US may be ready to go to the hilt.

Authors:

- Logan Finucan, Policy Analyst, Access Partnership

- Xiaomeng Lu, International Public Policy Manager, Access Partnership