Nur Ridhuan

Economics Strategy

Abhineet Kaul

Economics Strategy

Conversations that tackle trade and Asia typically involve pointing out the region’s dynamism and significant untapped potential. What sometimes remains missed is how large this opportunity is, and whether trends and data reveal the same story.

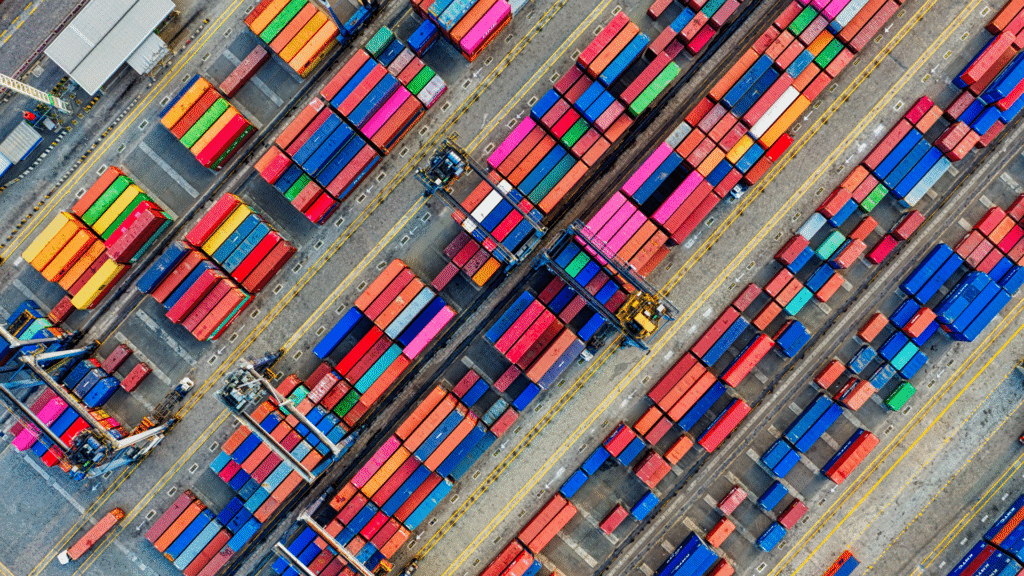

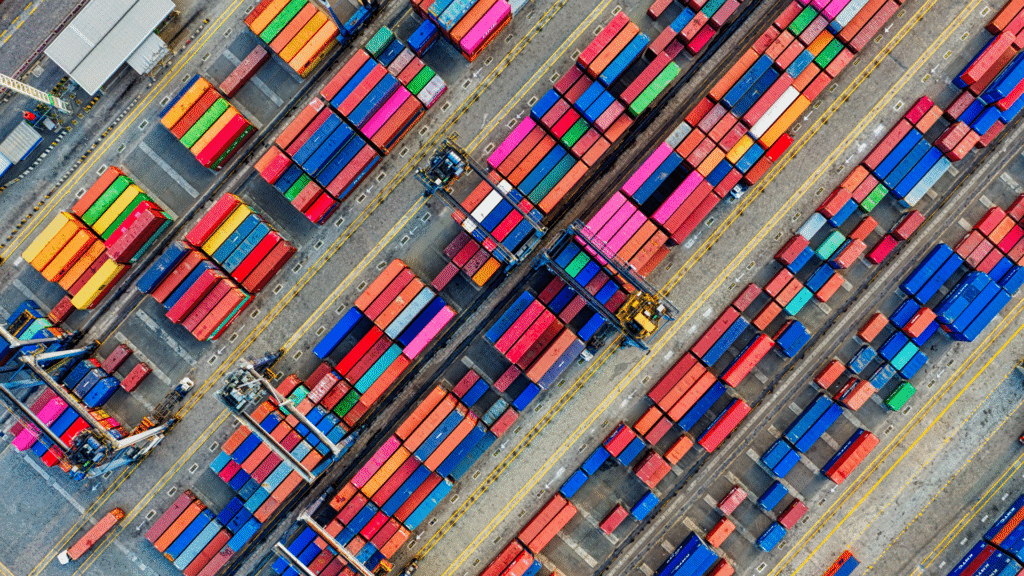

Asia is critical to global trade and is expected to only continue to grow in its importance. The past century saw Asia rapidly growing into the world’s largest manufacturing hub. Having deeply integrated with global supply chains and contributing at least 40% of global trade as of 2020, the region has played a key role in meeting burgeoning demand across the world. However, Asia is finding itself slowly shifting from being a sole producer of goods to becoming a large consuming market. In fact, 12 key Asian markets (the “Asia-12”) are set to lead this journey: Australia, China, Hong Kong, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. All of them together account for 88% of trade within Asia today – or around USD 6.4 trillion – which constitutes around one-third of global trade in 2020.

Analysis by Access Partnership estimates that trade among the Asia-12 could double to USD 13.5 trillion in 2030. Businesses have already begun to recognise this fact. Our survey of nearly 200 businesses in the Asia-12 revealed that around 77% were already preparing for a future where trade within Asia itself could experience accelerated growth. We were pleased to work closely with our partners at UPS to deliver these insights and more as part of our report, Clearing the Runway for Intra-Asia Trade, for which we invite feedback and contributions to drive the agenda forward.

This trade forecast is more than just mere projection, with several key trends already shaping this into reality. For example, the Asia-12 possess a strong, growing middle class and an increasingly urban population. Within the group, it is expected that another half a billion new individuals would join middle class population by 2030, enabling the Asia-12 to have a consuming class of around 1.5 billion people at the end of the period. At the same time, another 209 million more are expected to join urban cities across these economies – or approximately 21 million per year. Ambitious new trade deals such as the Regional Comprehensive Economic Partnership (RCEP), signed by 10 of the Asia-12 economies, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), signed by five of the Asia-12, are expected to further deepen trade links by broadening the scope of products included and facilitating easier customs clearance. Finally, supply chain innovation and the need to build greater resilience to disruptions will also drive intra-Asia trade, as more governments and businesses continue developing key infrastructure or integrating digital tools into their ecosystems to promote visibility over their supply chains.

Despite these significant tailwinds, multiple barriers threaten trade growth within Asia today. Inconsistent trade, customs regulations, and tariffs create unnecessary hurdles for businesses and consumers when engaging with traded goods. Major disruptions such as the COVID-19 pandemic created fragmented responses from government, with inconsistent restrictions on trade lanes, labour availability, and logistics support creating significant delays, uncertainty, and spiralling costs. Geopolitical conflicts, meanwhile, are steering the world toward increasingly costly trade disputes that shorten or exclude vulnerable segments of increasingly complex product supply chains and further raise costs of compliance. Finally, micro, small, and medium-sized enterprises (MSMEs) – 97% of businesses in Asia – continue to be left behind in global value chains due to lack of engagement by larger businesses and governments. If left unchecked, these trends could even cause intra-Asia trade to stagnate by 2030, thereby losing out on the opportunity to double.

To ensure that Asia can capture the intra-regional trade opportunity, multistakeholder action across four key areas is crucial. Action by businesses or government alone is not enough to address the key barriers to trade – active involvement by all stakeholders is imperative.

At Access Partnership, we continue to work with stakeholders such as UPS, governments, and industry participants to build greater resilience into their supply chains in Asia Pacific and beyond, while also working extensively on topics related to digital trade. If you would like to work with us on these issues, please reach out to [email protected] and [email protected].