While declarations on trade policy can’t be made with much certainty these days, we can be pretty sure about one thing: the next major step in the escalation of US-China trade tensions will happen on 15 June. On this Friday, the US Trade Representative (USTR) will release its final list of Chinese goods that will be subject to a 25% tariff.

The USTR released a provisional list in April, targeting USD 50 billion of Chinese goods, as one outcome of the so-called “Section 301” trade remedy investigation looking into Chinese forced technology-transfer practices. The proposed list was calibrated to both minimize the direct consumer impact as well as maximize the impact on the high tech Chinese industries the government prioritized under the “Made in China 2025” industrial strategy.

While President Donald Trump ordered the USTR to finalize the list by 15 June, it is not clear when exactly the US will impose tariffs. The USTR has a great deal of leeway under the Section 301 statute, which was designed to be used as a negotiation tool by maximizing the trade agency’s discretion to investigate harms, design responses, and determine the timing of remedies.

The action on Friday, whether to simply finalize the list of goods or to actually impose the tariffs, is designed to increase pressure on bilateral US-China trade talks. The two sides have been directly engaging since early May and have conducted several high-level exchanges to negotiate a package of measures that could avert tariffs. Despite the Section 301 investigation’s focus on specific Chinese practices that attempt to force technology transfer and discriminate against foreign technology and intellectual property interests, public reports these issues haven’t been a high priority in talks. Instead, the US has pushed for the rollback of the expansive Made in China 2025 strategy, which the Chinese have fiercely rejected, and focused on simple deficit reduction targets and agricultural goods.

China, for its part, has threatened to walk away from talks if the US imposes tariffs. They are likely to follow through on this threat in the near term if Trump implements tariffs immediately, which will likely result in further rounds of escalation before talks resume. However, the timetable is also intertwined with Chinese support for managing the North Korea issue, making it difficult to predict.

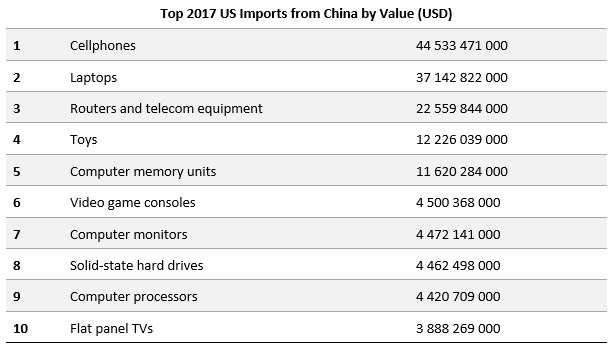

While consumers — unless you buy a lot of printer ink or are on the verge of buying a Chinese-assembled TV — will largely escape direct impact from this first round of USD 50 billion in tariffs, that would not be the case in a second round. The US has already threatened to identify a further USD 100 billion in goods that would be subject to tariff. Such an escalation would hurt much more, and would almost inevitably impact a much larger range of consumer and electronic goods.

Source: Peterson Institute for International Economics (PIIE)

While only one out of the top ten US imports from China by value was captured in the first list (flat panel TVs) remaining goods have much more potential to bring pain.

Author: Logan Finucan, Policy Analyst, Access Partnership